Table of Content

This does not require a separate home office or dedicated work area set aside in the home. If there is no regular pattern, then records of the duration and purpose of each occasion would need to be kept. There is an overall requirement that the basis of claims calculations be “reasonable”. Your return will be reviewed and checked by two Etax accountants before lodgement – giving you the confidence it was done right.

It is important to note that not all items you buy for an office are deemed essential. An armchair or sofa, for example, is not furniture that would be eligible for deductions. These may be added for aesthitics, but they’re not directly for work related use. Employees generally can’t claim for any occupancy expense such as rent or mortgage interest, but can claim for running costs such as internet costs, heating, lighting or cleaning related to working.

Calculating your working from home expenses

This does not apply to any equipment purchased for other members of your family, such as an iPad for homeschooling your kids. For new employees who are offered choice of super fund but fail to choose, you mustrequesttheir stapled super fund details from the ATO to meet your super obligations. Large private business entities will face more scrutiny of their tax affairs after newlegislationpassed through Parliament to require greater transparency of the tax affairs of private companies.

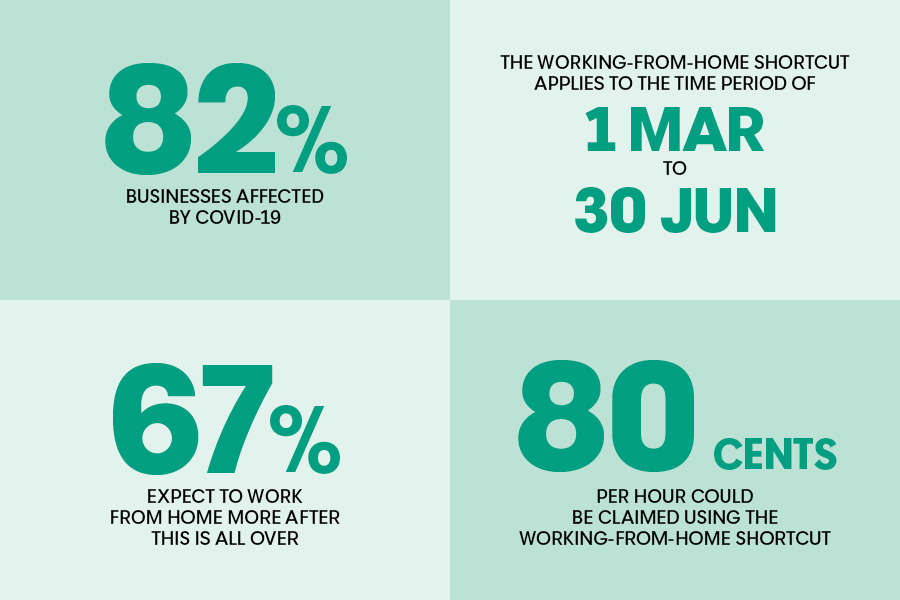

It allows taxpayers to claim a flat 80¢ an hour for work from home expenses incurred from 1 March 2020 to 30 June 2022. The government is yet to decide if there will be any further extensions. The ATO has a range offactsheets and resourcesavailable to help employers get their STP reporting right.

The list below are about specific tax deductions that might apply when you work from home:

If the worker instead gets a 1099-Misc reporting earnings, he or she is an independent contractor and may be able to claim work from home expenses. So if a worker is classified as an independent contractor rather than a regular employee, the above restrictions don’t apply. State and local government officials, either elected or appointed, may get to take deductions for home-based work expenses if they are compensated at least in part on a fee basis. If your home is not your principal place of business but you do some work from home, you may still be able to claim a deduction for some of your expenses relating to the area you use. Tax depreciation incentives – you may be eligible for an immediate deduction or an accelerated rate of depreciation under one of the tax depreciation incentives .

Work-related expenses will continue to look different from the pre-COVID time for a while yet. As the ATO is progressing on processing 2021 Tax Returns, they are taking a special interest in work from home deductions. From 1 July 2022, employers must make SG contributions at 10.5% for eligible employees regardless of how much they earn afterremovalof the $450 per month eligibility threshold.

Online services

From1 January 2023, fines will jump from $222 to $275 per penalty unit, a 19.3 per cent increase. With Single Touch Payroll Phase 2 reporting now well underway, small business employers need to remember their next reporting deadline is 1 January 2023. People with physical or mental disabilities that limit their ability to be employed can deduct expenses necessary for them to work from home, including attendant care. You must have a record of the hours you worked from home, for example, a timesheet, roster or diary. Can't claim any other expenses for working from home, even if you bought new equipment. You will need to meet the eligibility and record keeping requirements for the method you choose to use.

However, even if you’re not one of these, there are still a few possible ways for you to get tax deductions from your expense for working from home. A financial advisor can help you find every deduction and credit you are entitled to. Expenses for working from home are not deductible for most employees since the 2017 tax reform law. For people filing for tax years before 2018 work from home deductions can be used. Also, the current limitation on deductions is set to expire in 2025, so after that tax year expenses for working from home will again be deductible for many employees.

The temporary shortcut method simplifies how you calculate your deduction for working from home expenses. Before claiming a deduction for working from home expenses, you need to understand your circumstances. The information below is for employees, if you're running a home-based business, see Deductions for home-based business expenses.

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. The ATO is also reminding people that the three golden rules for deductions still apply. Taxpayers must have spent the money themselves and not have been reimbursed, the claim must be directly related to earning income, and there must be a record to substantiate the claim. This new shortcut arrangement does not prohibit people from making a working from home claim under existing arrangements, where you calculate all or part of your running expenses.

Their thinking was, you are not going to have any additional running expenses for that area, if the space is being used for other things anyway. It’s an easy way to make a claim for these items without trying to apportion a work vs personal amount for each one. Just keep a diary of how many hours you work from home each week and enter it on your tax return. Please note all of these expenses must be recorded and essential to your employment duties.

Claim a rate of 80 cents per work hour for all additional running expenses. She also wants to claim some additional gas, electricity, phone and internet costs due to working from home. The rate of 52 cents per hour applies in the periods from 1 July 2018 to 30 June 2022. A home office is a designated room or area in your home set aside just for work that is not shared by other people and not used for other purposes. So basically, your kitchen table or the desk in your living room aren’t going to cut it as a home office in the eyes of the ATO.