Table of Content

Whether you work for yourself or are involuntarily working from home, let’s dive into the different categories available as claiming expenses. Please give us a call if you have any queries about what you can & can’t claim or what records to keep. The previous grandfathering of the exemption applying to certain large proprietary companies from the normal obligation to lodge their annual reports with ASIC was also removed. Taxpayers running afoul of the taxman will find themselves facing bigger bills this year after the Federal Budget included measures to increase the fines for regulatory penalty units.

It is important to note that not all items you buy for an office are deemed essential. An armchair or sofa, for example, is not furniture that would be eligible for deductions. These may be added for aesthitics, but they’re not directly for work related use. Employees generally can’t claim for any occupancy expense such as rent or mortgage interest, but can claim for running costs such as internet costs, heating, lighting or cleaning related to working.

APRA-regulated funds

This gives you a fixed rate of 52 cents per hour worked at home deduction. The fixed rate method is great if you have your own dedicated work area, phone and your own internet for work. The original 52 cents per hour method does not include other expenses such as, phone and internet costs, computer consumables, stationery or the work related portion of the decline in value of office equipment. You claim each of those items separately, and usually get a bigger refund. We go into more detail with examples of this on our dedicated “working from home due to COVID-19” article.

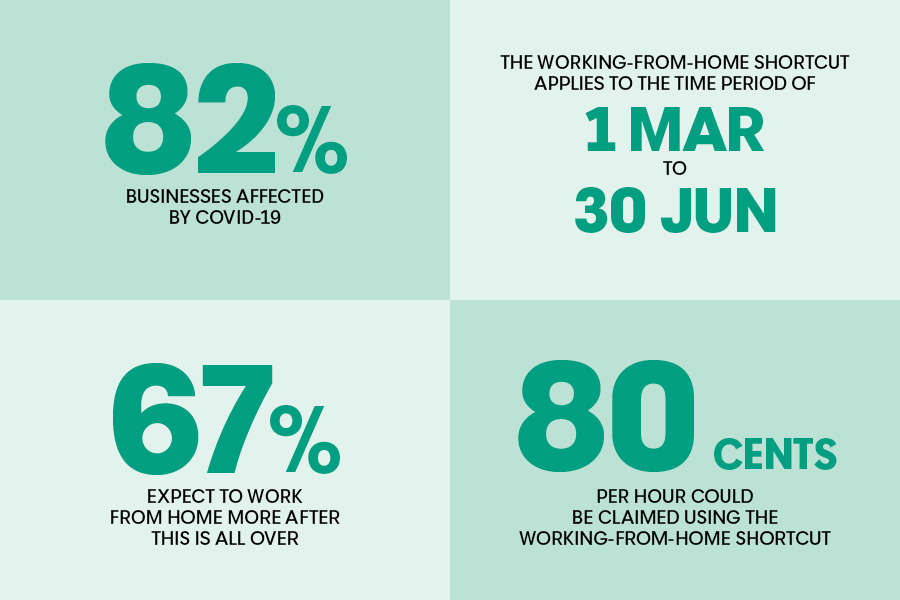

For the duration of this period, the ATO allows home office deduction claims without the need for you to have an actual office. So you can now claim home office expenses if you work from the kitchen table or from your sofa. One advantage of the shortcut method is that taxpayers do not require a dedicated workspace at home, a necessity for the other two ways to claim.

Calculating your working from home expenses

Also, if you’ve already claimed these travel expenses back in a different section of your tax return, you’ll not be eligible to claim again. So, please keep your records & receipts so that you can claim the correct, maximum amount of tax deductions in your return. Alternatively, employees working from home can claim a deduction for their expenses using the traditionalactual cost method. Taxpayers working from home are likely to face significant rule changes when claiming tax deductions this financial year following release of the ATO’sdraft guidanceon the issue. The ATO will receive $685 million over four years to help it raise $2.1 billion from a crackdown on shadow economy activities. This may be of concern to some small and mid-size enterprises , as the ATO believes the bulk of these activities occur among smaller business taxpayers.

Claims for working from home expenses prior to 1 March 2020 cannot be calculated using the shortcut method, and must use the pre-existing working from home approach and requirements. “This recognises that many taxpayers are working from home for the first time and makes claiming a deduction much easier. For example, a couple living together could each individually claim the 80 cents per hour rate.

Doing Business in New Zealand

If you’re ready to find an advisor who can help you achieve your financial goals,get started now. Determining whether a worker is an employee or independent contractor can be complicated and the IRS makes the determination on a case-by-case basis. However, generally speaking, if a worker receives a W-2 statement showing wages paid and taxes withheld, he or she is an employee.

As part of their pandemic responses, some states are requiring employers to reimburse employees for expenses if the employers are requiring employees to work from home. In order to keep employees form having to report reimbursements as taxable income, employers may n need to set up specific policies describing which expenses are subject to reimbursement. This IRS form is then attached to the main 1040 tax return and the work from home expenses are reported on Schedule A, the schedule for itemized deductions. It's important to keep the right records to work out your deductions or CGT. The shortcut method is just one of three ways available to work out your deduction for working from home expenses. For more information about what you can claim and the other methods available, see Working from home expenses.

If your employer pays you an allowance to cover your working from home expenses, you must include it as income in your tax return. You can claim a deduction for the additional running expenses you incur as a result of working from home. The “Shortcut Method” is a new way to claim all deductible running expenses at a higher hourly rate . To claim these back as home office expenses, keep all records of payment and ensure that they are work costs related.

We understand that due to COVID-19 your working arrangements may have changed. If you have been working from home, you may have expenses you can claim a deduction for at tax time. Claim the actual work-related portion of all your running expenses, which you need to calculate on a reasonable basis.

It allows taxpayers to claim a flat 80¢ an hour for work from home expenses incurred from 1 March 2020 to 30 June 2022. The government is yet to decide if there will be any further extensions. The ATO has a range offactsheets and resourcesavailable to help employers get their STP reporting right.

The temporary shortcut method simplifies how you calculate your deduction for working from home expenses. Before claiming a deduction for working from home expenses, you need to understand your circumstances. The information below is for employees, if you're running a home-based business, see Deductions for home-based business expenses.

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. The ATO is also reminding people that the three golden rules for deductions still apply. Taxpayers must have spent the money themselves and not have been reimbursed, the claim must be directly related to earning income, and there must be a record to substantiate the claim. This new shortcut arrangement does not prohibit people from making a working from home claim under existing arrangements, where you calculate all or part of your running expenses.

Claim a rate of 80 cents per work hour for all additional running expenses. She also wants to claim some additional gas, electricity, phone and internet costs due to working from home. The rate of 52 cents per hour applies in the periods from 1 July 2018 to 30 June 2022. A home office is a designated room or area in your home set aside just for work that is not shared by other people and not used for other purposes. So basically, your kitchen table or the desk in your living room aren’t going to cut it as a home office in the eyes of the ATO.

You are free to copy, adapt, modify, transmit and distribute this material as you wish .

No comments:

Post a Comment